Businessolver® Client Newsletter

09/24/2024

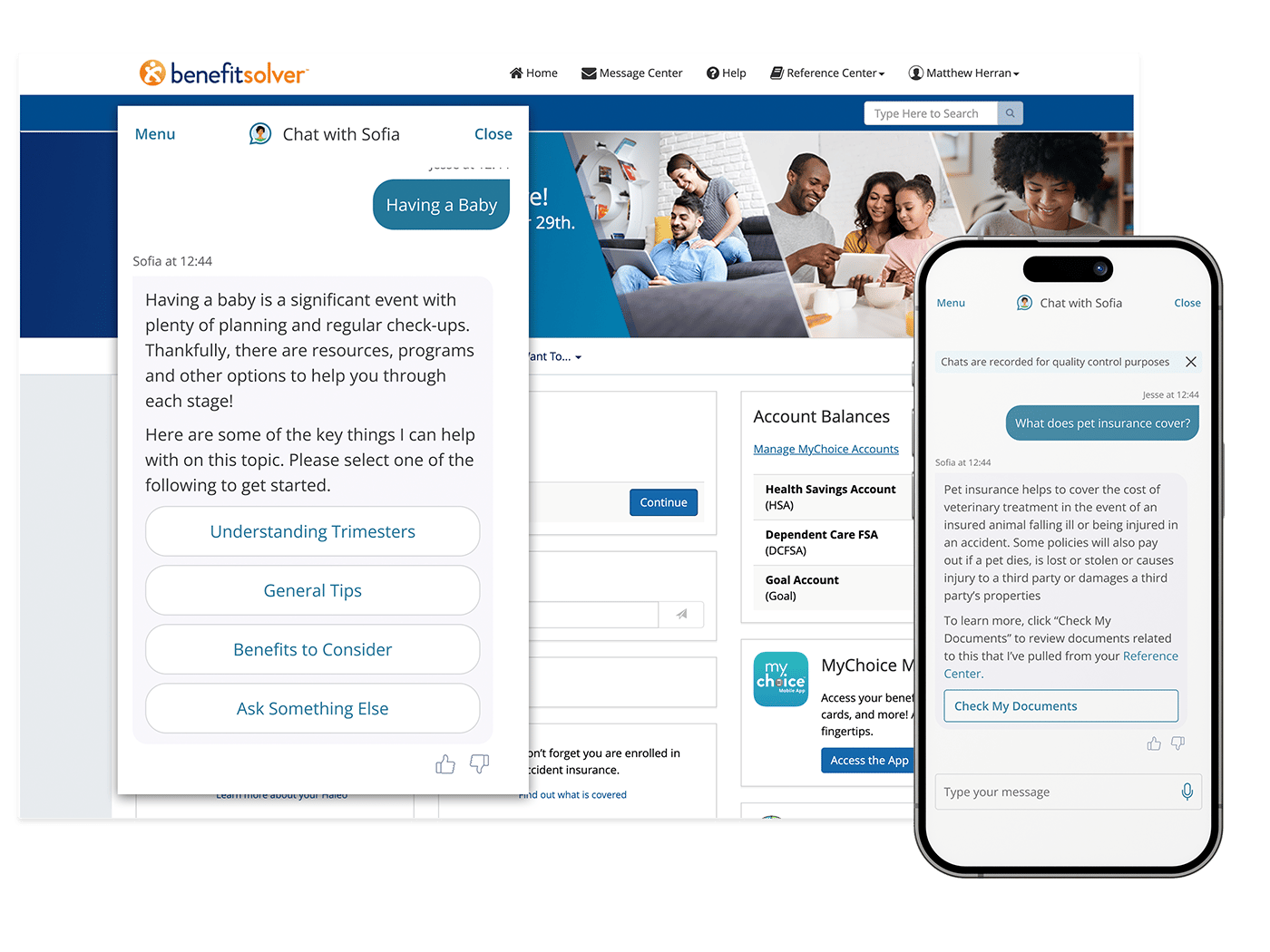

Optimize your Employee Experience

Create your best experience with these tips

As you work through the final touches on your Annual Enrollment setup within Benefitsolver![]() ®, keep these important tips in mind to get the most out of the employee experience. Walk through these tips with your client team at your next weekly meeting!

®, keep these important tips in mind to get the most out of the employee experience. Walk through these tips with your client team at your next weekly meeting!

1. Review vendor set-up

-

Ensure all vendor names, phone numbers, and websites are current.

2. Review your Reference Center

-

Ensure your file names are all meaningful (not abbreviated) – i.e., name the file Benefits Guide - Medical Plan rather than BG_MEDPLN or use Summary of Benefits for New Hires rather than SMB-NH—also, there is no need for underscores here.

- Enable active documents and check visibility.

- Add tags where applicable. Delete or disable anything outdated.

3. Update Plan Detail

-

Even if you don’t leverage decision support, Sofia and plan compare can pull information about what is covered from this section of Benefitsolver. Things like deductible amounts, out-of-pocket maximums, coinsurance, and other plan details can even be pulled into the mobile app.

4. Review Service Center Discovery Tab with your client team

-

Easily set up client announcements to show in Sofia AND pop up in the mobile app.

-

Review other modifiable fields to ensure we can pull all relevant information in.

Engaging Your Employees Year-Round

Tips and tricks for maximizing your benefits communications

Whether you’re about to dive into AE or recovering from a mid-year enrollment, it’s always a good time to brush up on benefits communications ideas. We’ve created a handy checklist that might give you some fresh ideas or remind you of best practices

Benefits Pulse Newsletter

The Benefits Pulse: 77% of Working Parents Say Flexibility Is Key to Staying with their Employer

9/16 was National Working Parents Day

Our latest Benefits Pulse newsletter and podcast dive into which benefits are crucial to supporting working parents and other caregivers in your organization.

P.S. - Make sure you subscribe to the Benefits Pulse newsletter to keep a beat on HR Trends!

HR Tech Starts Today!

Stop by our booth and say hello

If you’re in Vegas this week, there’s lots of way you can connect with your friends at Businessolver at booth #7909:

- Enjoy a beverage or snack at our bar.

- Win prizes at our mini-golf experience or Plinko wall.

- Enter our sweepstakes for a chance to win tickets to a TGL Match.

- Join our Par-tee at S Bar TONIGHT after the bar crawl from 7:15 – 9:15 p.m.

- Attend our session on Wed., Sept. 25, 10:45 – 11:30 a.m. on blending empathetic service and innovative technology to improve cost savings and increase employee engagement.

We hope to see you there!

What’s New in Compliance?

MyChoice® Accounts Clients: NDT Requests for 2024 due by Sept. 30

MyChoice Accounts is scoping operations work needed through the end of the year. If you plan to run non-discrimination testing in the remainder of 2024, please submit your request to your client service lead by Monday, Sept. 30, so they can initiate the process. Requests received after Sept. 30 may not be processed.

Final MHPAEA rules released by HHS, Labor and Treasury Departments

On Sept. 9, 2024, the U.S. Departments of Health and Human Services (HHS), Labor, and the Treasury released final rules implementing the Mental Health Parity and Addiction Equity Act (MHPAEA). The new rules include new regulations timeframes for responding to requests for nonquantitative treatment limitation (NQTL) comparative analyses required under MHPAEA.

These final rules work to ensure that covered individuals seeking mental health or substance use disorder (MH/SUD) care do not face additional barriers or restrictions than those placed on medical or surgical (M/S) treatment and cannot use NQTLs for MD/SUD that are more restrictive than those applied to M/S.

For more information, check out the Departments’ news release and fact sheet.

IRS releases 2025 ACA Affordability Percentage

The IRS has released the 2025 ACA Affordability Percentage. For plan years beginning in calendar year 2025, the Required Contribution Percentage is now 9.02%. This is an increase from 8.39% in 2024.

Read the IRS update.

Upcoming Sessions

Tues., Oct. 8 at 10 a.m. CT: Roundtable – Q4 MyChoice Accounts Product Update

Join us for our Q4 MyChoice Accounts Product Update. We’ll discuss important updates and enhancements from Q3 and things to look for in the rest of the year and beyond.

Tues., Oct. 15 at 10 a.m. CT: Q4 Product & Compliance Update

Don’t miss our Q4 Product & Compliance Update. We’ll cover recent and upcoming product enhancements and give updates on AE readiness. As always, Bruce Gillis, Head of Compliance, will join to cover the timely compliance items you should know about.

In Case You Missed It

Evaluating Point Solutions for Maximum Returns Roundtable

Were you able to join our Pinnacle Partners and us at last week’s roundtable? If not, consider checking it out on demand, as it’s a great way to hear from many of our partners in just over an hour. Don’t miss this opportunity to one-stop-shop our Pinnacle Partners and learn about the engagement and savings you can realize with them.

A Peek at Our Pinnacle Partners

Prudential: Delivering solutions for a smarter, seamless experience

Prudential believes financial wellness is for everyone—putting it at the core of everything they do. They are one of the world’s largest financial services institutions, offering a wide array of financial products and services, including life insurance, annuities, retirement-related services, mutual funds, and investment management. Prudential provides solutions that help prepare and protect your employees from the unexpected so they can stay on track through life’s twists and turns.

Together, Prudential and Businessolver help your workforce get the financial protection and support they need. Through simple and efficient delivery, we’re making it easy for you and your employees to manage benefits no matter where the work gets done.

Transitions Benefits Group: Education and enrollment services for aging workforces

Transitions Benefit Group is a national organization that provides education and enrollment services that address the needs of your aging workforce and sandwich-generation employees. They deliver a proactive approach to educating on topics across Medicare options, Social Security planning, retirement readiness, COBRA alternatives, and retiree group healthcare chassis to help reduce your risk exposure and overall healthcare spend.

Together, Transitions Benefits Group and Businessolver ensure employees have a diverse suite of benefit options through the Benefitsolver ecosystem that is valuable, compassionate, and versatile.