Businessolver® Client Newsletter

05/13/2025

Preferred Names for Members & Dependents

Providing a more enhanced, personalized experience

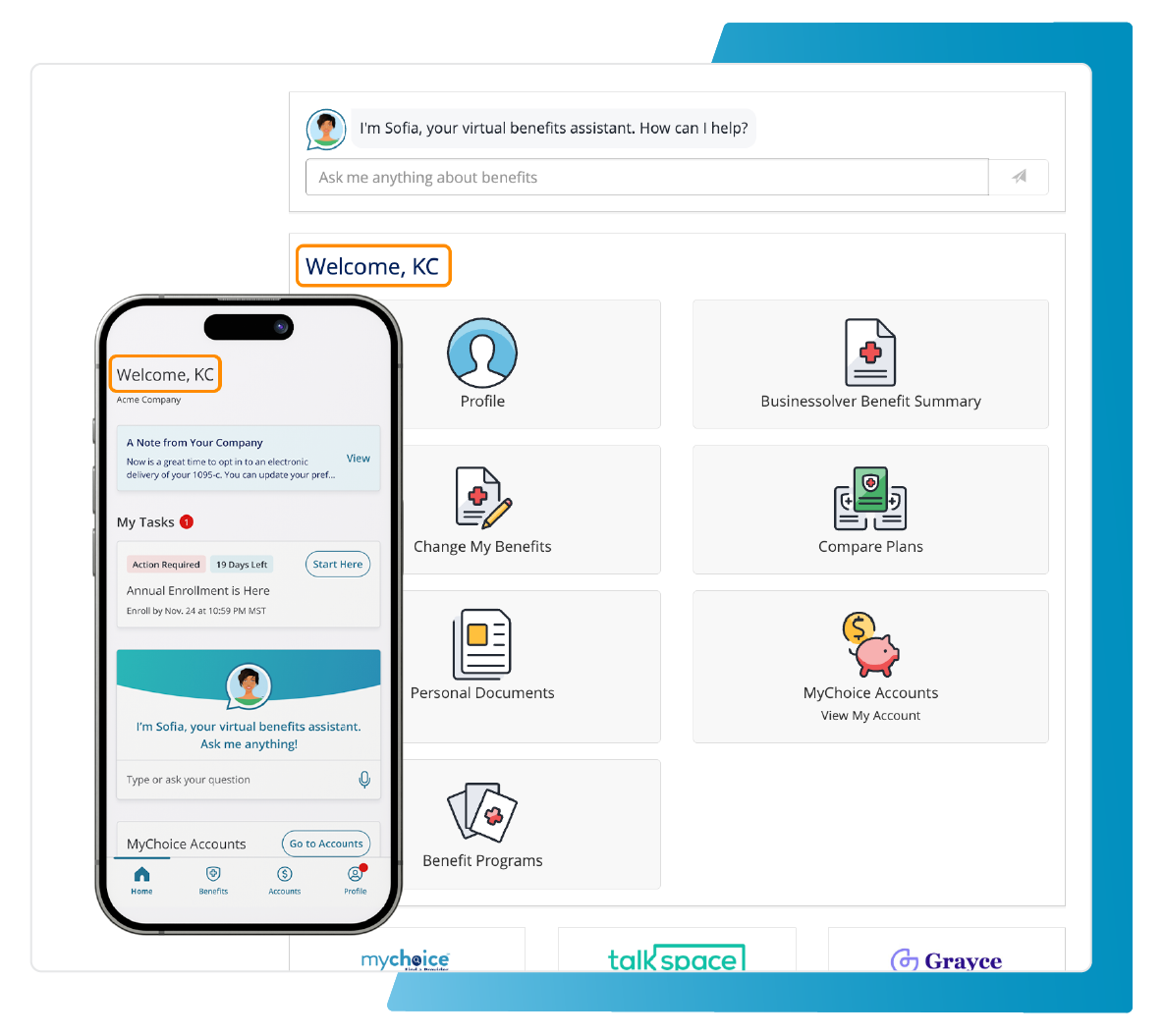

Many people have preferred names that are different from the name on their birth certificate. For example, Kaytlin Claire Jones may go by KC. Businessolver now support the use of preferred names throughout the system for both members and dependents. Clients must opt in to use preferred names; it will not happen automatically. If a client does opt in, members and dependents will be greeted with their preferred name when they manage their benefits, interact with an administrator, or review member-facing communications.

Certain print mail documentation requires us to use a person’s legal name. We have a safeguard in place to ensure we use the legal name when necessary to remain compliant.

Please reach out to your client services team if you’d like more information about preferred name or would like to opt in.

A tool to help members use self-service features

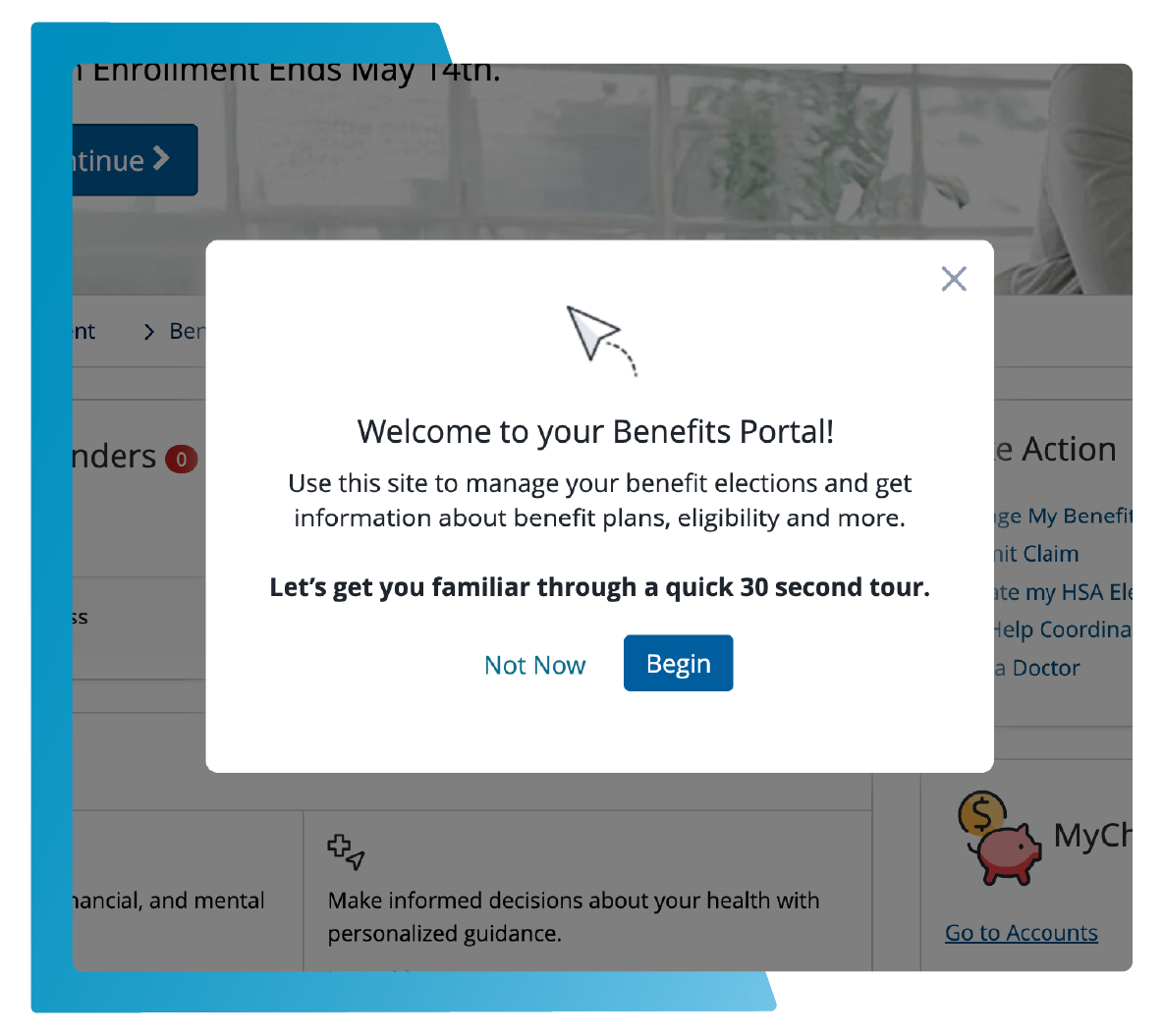

The member onboarding guide is a step-by-step tutorial that pops up within a member’s Benefitsolver® on the key features that support them within the Benefitsolver experience. It will enable newcomers to the system to quickly get acquainted with the available tools and promote self-service upon their initial login. In a pilot run of this guide, we saw tremendous results including a 74% increase in mobile app usage year-over-year.

We are planning to deploy the Member Onboarding Guide for all clients on May 30. Clients who want the guides turned off or only enabled for certain populations can work with their CSL before May 30 to accomplish that.

For more information, check out our Q2 product update where we discussed and previewed the new Member Onboarding Guide.

MyChoice® Accounts Dashboard Updates

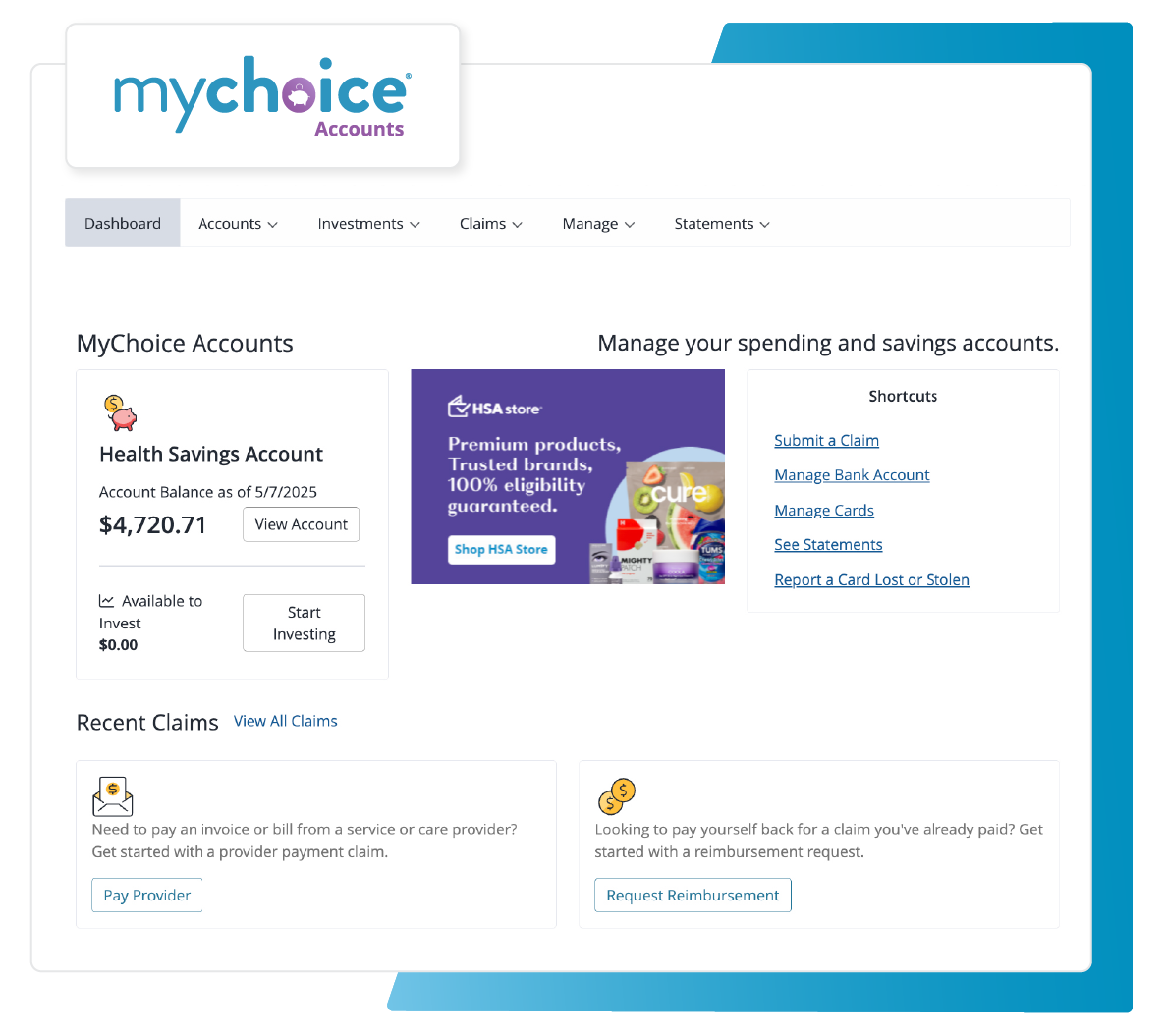

A new view plus embedded member user guides

This week, MyChoice Accounts members will have an enhanced visual view of their accounts as they log in to the accounts dashboard. Based on member testing and client feedback, we’ve made the most pertinent information more easily accessible on the dashboard and provided the most-used shortcuts to member actions. Additionally, members will be able to view their most recent claims and progress directly on the dashboard. Finally, over the next few months, we are adding user guides throughout the MyChoice Accounts system to help members understand next steps and terms used in the system.

For more details, check out our Q2 MyChoice Accounts product update.

Vision 2025 On Demand

Check out our three insightful sessions on your time

We hope you were able to join us for Vision 2025 last week. We had a great time discussing the road ahead and diving into our product roadmap. Plus, we loved celebrating HR leaders who embody our Employee of the Decade spirit.

If you, or any your team, weren’t able to attend, check out Vision on demand! All three sessions are available for you to watch at your convenience. Maybe you did attend but want to get another look at an enhancement we discussed in our product roadmap session – you can do that!

Thanks to you all for making this another great Vision event.

What’s New in Compliance?

IRS Announces HSA, HDHP, and HRA Limits for 2026

The IRS has issued the 2026 inflation adjusted amounts for Health Savings Accounts (HSA), HDHP (high deductible health plans) deductibles, and Health Reimbursement Arrangements (HRA). For calendar year 2026, the deductible minimums for HDHPs are $1,700 for self-only coverage and $3,400 for family coverage. Out of pocket maximums are $8,500 for self-only coverage and $17,000 for family coverage. For plan years beginning in 2026, the maximum amount that may be made newly available for the plan year for an excepted benefit HRA is $2,200. HSA employee contributions for 2026 are limited to $4,400 for self-only coverage and $8,750 for those with family coverage in their HDHP.

Today's Sessions

TODAY at 10 a.m. CT: MyChoice Accounts Training // MyChoice Accounts – Account Suspension & Reporting

Join us today to dive into the tools and processes that drive success in MyChoice Accounts with this interactive session. Our system experts will demonstrate how to extract valuable insights from the reporting suite, answering common questions like “How do I find…?” and showcasing strategies to get the most out of your data. This session offers a comprehensive look at leveraging data and supporting members through critical account processes.

Join today’s training

Upcoming Sessions

Thurs., May 15 at 10 a.m. CT: Benefitsolver Training // Data-Driven Insights: Reporting and Analytics

Data is one of your most valuable resources, and Benefitsolver makes it easy to extract and leverage that data to achieve your goals. Join our subject matter experts for this training where they’ll guide you through the tools and strategies needed to get the most out of your Benefitsolver reporting capabilities.

Add to schedule

Tues., May 20 at 10 a.m. CT: Benefitsolver Roundtable // Engage and Empower – Year-Round Communication Strategies

Join this panelist discussion with benefits communication experts to explore how to elevate your total rewards strategy through impactful, year-round communication. Learn how to effectively "market" your benefits, adopt an employee-centered approach to showcasing total rewards, and boost utilization with proven strategies.

Add to schedule

Thurs., May 29 at 10 a.m. CT: Benefitsolver Training // Become a Benefitsolver Pro

Ready to elevate your Benefitsolver expertise? This session is designed to help you take your knowledge to the next level. A crowd favorite, this interactive session will walk you through how data flows in and out of Benefitsolver, ensuring you’re equipped to manage imports, member records, and exports with confidence. Plus, we’ll spotlight key Admin Tools and Widgets that make your workflow even more efficient.

Add to schedule

Log in to the Hub

Not registered for the hub yet? Click here to sign up.

A Peek at Our Pinnacle Partners: MetLife

Accommodating unique workforces for every life stage and budget

Metlife is among the largest global providers of insurance, annuities, and employee benefit programs, with 90 million customers in over 60 countries. They know that the one thing that you can predict about life is that it’s unpredictable. Your employees have different lifestyles but they can all use help preparing for the unexpected. Voluntary benefits can cover insurance gaps and help protect your employees.

Together, Businessolver and Metlife know the importance of keeping your workforce safe. MetLife offers your employees the right mix of benefits, that helps you reduce financial risk and improve wellness. All while providing quality, flexibility and innovation.