Businessolver® Client Newsletter

06/10/2025

The One Thing: Set Up Decision Support for 2026 Annual Enrollment

It’s not too late to take advantage of this powerful tool

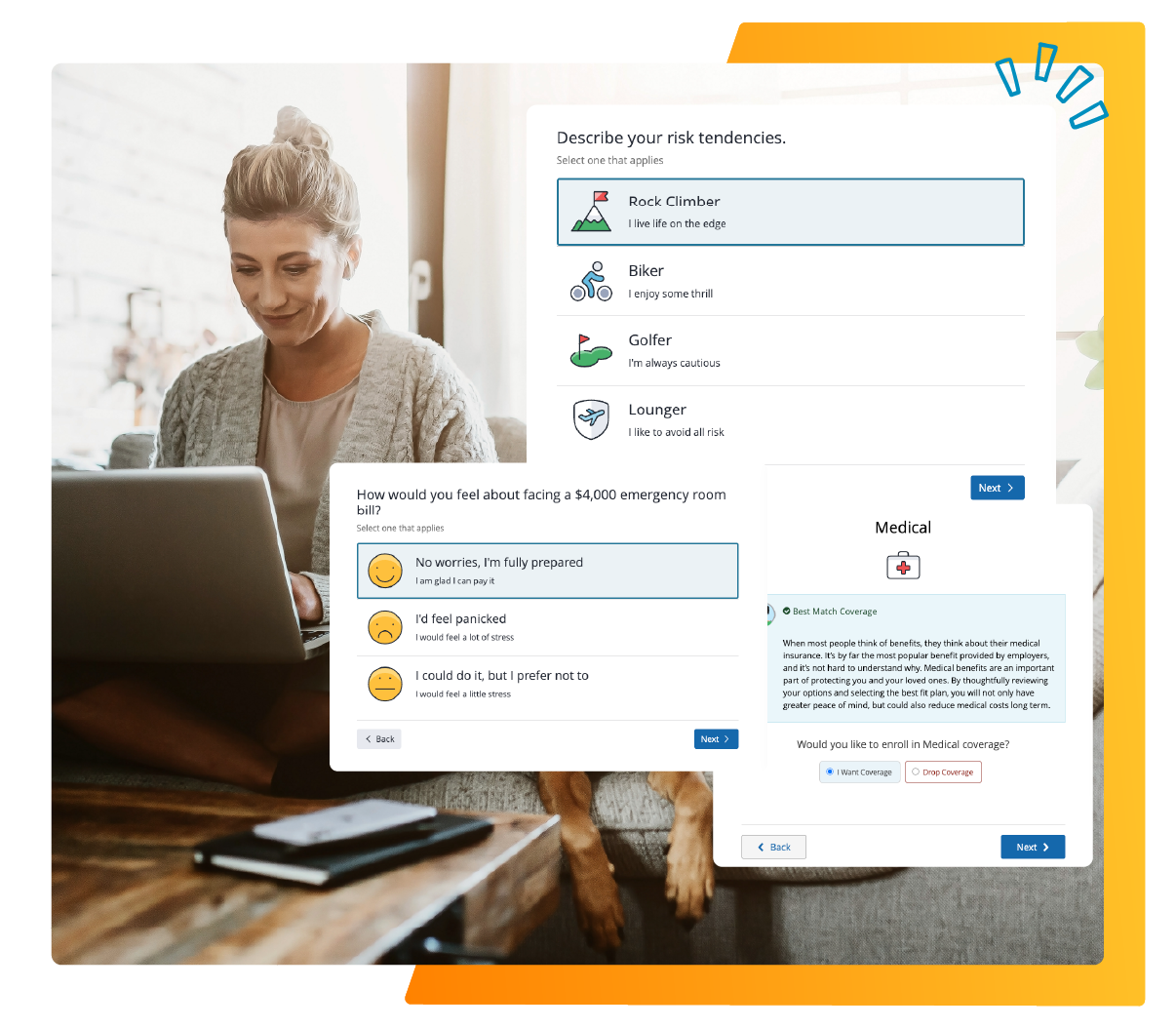

Are your members enrolling in the right coverage for their specific situation? With 86% of members remaining confused about their benefits, it’s a tall task for anyone to make the right benefits choices without proper support.

The good news? With proper support, members can make the right benefits choices and feel confident about their enrollment. For our 2025 enrollment, 84% of members rated their enrollment experience as ‘great’ when they had decision support.

On top of that, we found that members were 119% more likely to enroll in a high-deductible health plan when they have decision support available to them at enrollment and understand the value of pairing that plan with an HSA.

Interested in learning more about decision support? It’s a free tool included in your Benefitsolver investment. We hosted a training last week that went deep on decision support setup and the benefits of this tool.

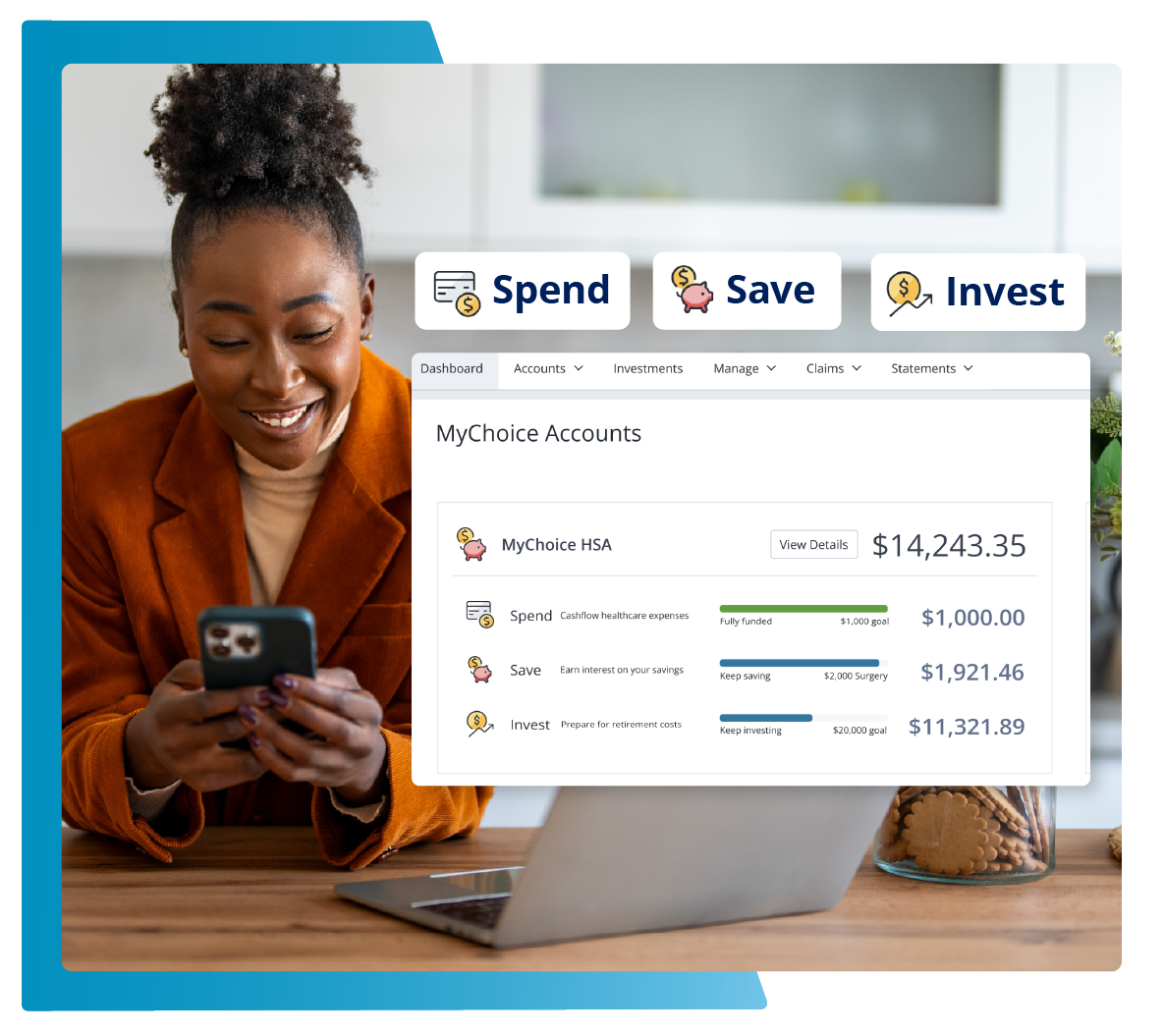

MyChoice HSA: Spend, Save, Invest

A money market account for your members’ goals

MyChoice Accounts HSA members are getting another way to save this August. As we continue to drive value and education for HSAs, we are helping members set goals for their savings. The MyChoice HSA will be adding a money market save option and prompting members to set aside funds for a specific goal, like dental work, upcoming surgery, orthodontics—whatever a member needs.

The money market account grows at a higher interest rate than the cash spend account, while helping members who may not be ready to or able to invest or who want an additional lower risk option. It’s a great new feature that works alongside our investment line-up of ETFs that can give members peace of mind for the future.

Tech with Heart Resources Site

A one-stop-shop for member communications, toolkits, and more

When did you last check out our Tech with Heart Resources site? It’s a great time to familiarize yourself with everything the site offers before we reach annual enrollment. This site is updated to always have the most up-to-date information and can be an incredibly valuable resource. Beyond being a great tool for Benefitsolver® clients, this site also hosts important MyChoice Accounts information.

Within the site, you’ll find:

- Our Businessolver® AE Fulfillment and Communications Support site that includes standard AE print and email templates, flyers, and more.

- Our Compliance Inventory that can help you stay current on all things compliance.

- Our logos and branding in case you need them for any of your own communications.

- Toolkits that you can use to help members take advantage of SofiaSM, the MyChoice® Mobile App, and Decision support.

- MyChoice Accounts details and member-facing communication. And much more!

What’s New in Compliance?

Departments of Labor, HHS, and Treasury seek to strengthen cost transparency in healthcare

The Departments of Labor, Health and Human Services, and the Treasury are working together to make healthcare costs more transparent. They’ve issued an RFI (Request for Information) asking for public input on how to improve the way prescription drug prices are shared with the public. They want feedback on current data and any innovative ideas for improvement. The agencies also released updated guidance for health plans and issuers that sets out a clear applicability date for publishing an enhanced technical format for disclosures.

Meanwhile, the Centers for Medicare and Medicaid Services (CMS) is requiring hospitals to post real prices for their services—not estimates. CMS also issued an RFI asking for public input on how to ensure hospitals follow these rules and provide accurate information.

For more information, review the press release, hospital transparency guidance, and ACA FAQs Part 70.

Additionally, you can review the hospital transparency and prescription drug price RFIs.

The ‘Big Beautiful Bill’ contains several big changes for HSAs and FSAs – be ready in case it becomes law

The One Big Beautiful Bill Act includes several notable changes that will impact HSAs and FSAs, with an impact beginning in 2026 if the bill is passed. While not enacted at the time of publication, the bill contains a variety of changes to HSAs and FSAs, most notably:

- People that are Medicare eligible by age would still be allowed to contribute to an HSA.

- Bronze and catastrophic plan members would be eligible to contribute to an HSA.

- If a spouse is enrolled in an FSA, the employee could still contribute to an HSA.

- Both spouses could contribute catch up contributions to the same HSA account.

- Up to $500 paid to gyms/fitness considered medical care for reimbursement purposes.

It is important to note this isn’t enacted today. But, should it become law, this would bring about several changes to employers' group health benefits programs.

Read the bill for more detail.

Upcoming Sessions

Tues., June 17 at 10 a.m. CT: Businessolver Roundtable // Delivering the Most Bang for your Tax-Advantaged Bucks

Our client DHL Supply Chain challenged us to deliver with MyChoice Accounts. With a large, complex workforce, they sought seamless integration and ease for FSA, HSA, Commuter, and Tuition Assistance benefits. Join Amanda Gigliotti, Benefits Analyst, and our MyChoice Accounts team to explore how these consumer accounts support their benefits strategy and the unique challenges they've faced and get some tips and tricks for strategies that might help your accounts strategy too.

Add to schedule

Thurs., July 10 at 10 a.m. CT: MyChoice Accounts Training // Claims Processing from A – Z

When it comes to MyChoice Accounts, our processing teams and debit card magicians are behind the scenes processing nearly half a million claims and more than 4 million card swipes per year. Join our claims expert as he gives you a tour of what processing looks like behind the scenes and explain the specifications required by the IRS for a successful, paid claim.

This session was originally scheduled for June, but we've moved it to July 10. If you've added the June session to your calendar, please remove it and replace it with the July 10 so you don't miss us!

Add to schedule

Log in to the Hub

Not registered for the hub yet? Click here to sign up.

A Peek at Our Pinnacle Partners: Heart Health & Hypertension Support

Drive healthier behavior and improve member heart health with Hello Heart

Did you know that the leading cost of death for U.S. adults is heart disease? Nearly 50% of American adults have some form of cardiovascular disease, according to the American Heart Association. What resources can you provide your employees to help them live a healthier life?

Enter our Pinnacle Partner, Hello Heart. Their mission is to empower people to understand and improve their heart health using technology. The company’s solution helps people manage their blood pressure, pulse, medications, and activity using AI-based technology and digital coaching. Users can track key health metrics, receive personalized feedback, and take steps to improve their health with clinically proven suggestions, all through the convenience of their smartphone. Plus, Hello Heart makes it easy for members to share this information with their doctors.

Validated in peer-reviewed studies and trusted by leading Fortune 500 companies, Hello Heart is easy to use and works alongside Benefitsolver to help your members have healthier outcomes.